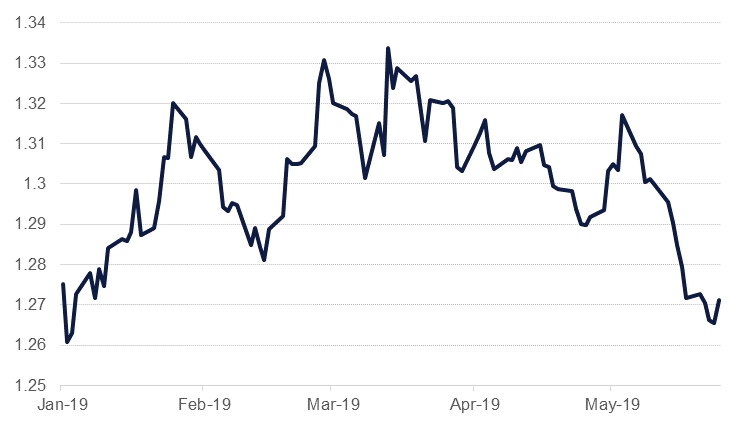

Economic data over the end of last week were subsumed by political developments, not least of which was Theresa May’s decision to resign as prime minister of the UK. May’s position had been tenuous for months as she had failed repeatedly to get her Brexit deal supported in parliament and she faced considerable opposition from within her own Conservative party. However, with May to step down as prime minister from June the outlook for Brexit is not any clearer. Should the Conservative party support Boris Johnson, the current front runner, to be the next prime minister the chances of a no deal Brexit will increase as the EU may rebuff attempts to negotiate a new deal and Johnson himself has said that the next prime minister must deliver on Brexit. Apart from Johnson, several of the other leading candidates for Conservative leader, such as former Brexit secretary Dominic Raab, also appear likely to endorse a harder Brexit rather than stick with the current deal.

Given that May’s resignation had been widely expected, sterling actually rallied on the news. There may have been an element of profit taking as investors closed out short positions on cable helpng to support the currency on the resignation news. However, with the outlook for Brexit until the end of October deadline still highly uncertain, more downside for the currency could be on the cards. Indeed, more uncertainty or even a further delay, if the EU accepts another extension, would push out the timing for any rate hikes by the Bank of England and see investment and growth drift.

Durable goods orders in the US came in softer for April, declining by more than 2% month on month. Most of the decline was attributable to a drop in commercial vehicle orders as airlines defer purchases of Boeing aircraft affected by safety issues. However, vehicle sales also fell (3.4% m/m) while core orders were flat. The soft data comes amid an escalating storm around US president Trump as the potential of a US-China trade deal looks distant and domestic political pressure rises. Trump is in Japan to try and negotiate a trade deal that would wind-down some of the country’s trade surplus with the US.

Final results from India’s parliamentary election saw prime minister Narendra Modi’s BJP returned to power with a larger majority than its win in 2014. Market focus will now turn to the shape of Modi’s next cabinet, particularly if Arun Jaitley will return as finance minister.

Source: Emirates NBD Research

Source: Emirates NBD Research

Treasuries closed higher as trade tantrums continued and geopolitical tensions increased. Further, the minutes of Federal Reserve’s last meeting showed that the central bank is likely to remain patient. Yields on the 2y UST, 5y UST and 10y UST ended the week at 2.16% (-3 bps w-o-w), 2.12% (-5 bps w-o-w) and 2.32% (-7 bps w-o-w) respectively.

Italian bonds rallied after comments from the Deputy Prime Minister Salvini that he would be willing to talk to French and German leaders to try to secure a higher deficit ceiling. Yields on 10y Italian bonds dropped 10 bps w-o-w to 2.18%.

Regional bonds continued to trade in a tight range. The YTW on Bloomberg Barclays GCC Credit and High Yield index dropped 4 bps w-o-w to 3.95% while credit spreads remained flat at 171 bps.

A rise of 0.42% last week saw EURUSD close the week at 1.1204, cancelling half of the declines of the previous week. The price had fallen to 1.1107, a new 2019 low before paring these declines on Thursday and Friday. Despite this gain, the price remains below the 50-day moving average (presently 1.1231), an area which has acted as a level of resistance since failing as a support in March 2019. In order to obtain further meaningful gains, a confirmed daily close above this level is required.

GBPUSD finished the week almost unchanged at 1.2714. However the price fluctuated significantly over the week, trading from as high as 1.2813 to as low as 1.2606. Despite breaking below the 23.6% one-year Fibonacci retracement during the week (1.2684), Friday’s relief rally saw the price end the week above this level. However, while the price remains below the 1.2830 level (not far from the 38.2% one-year Fibonacci retracement 1.2835), the path of least resistance is to the downside and a break below the 23.6% one-year Fibonacci retracement may catalyse a bigger loss towards the 1.25 handle.

The Egyptian pound strengthened to EGP16.89/USD on Thursday, levels not seen since March 2017, in the wake of the Central Bank of Egypt’s decision to maintain interest rates at existing levels. The MPC kept its benchmark overnight deposit and overnight lending rates unchanged at 15.75% and 16.75% respectively, citing inflationary pressures related to high oil prices and upcoming subsidy reforms. We maintain our expectation that rates will be held through the summer months, remaining supportive of the EGP as the country stays attractive to carry traders.

Regional equities started the week on a negative note. The DFM index and the Tadawul closed lower. National Medical Care continued to rally after NMC said it completed an agreement with the company to form a joint venture in Saudi Arabia.

Fears that the trade war between the US and China will escalate pushed oil prices lower last week with both Brent and WTI futures recording their largest weekly loss for 2019. Brent fell 4.9% to settle at USD 68.69/b while WTI ended the week at USD 58.63/b, down nearly 6.6%. The weak performance stretched across benchmark equity markets and industrial commodities as investors anticipate trade relations between the US and China getting worse before they get better.

Despite the weakness in spot prices, the front end of the Brent curve actually saw backwardation widen last week. Spreads for 1-2 months hit USD 1.22/b at the end of the week, compared with USD 0.95/b a week earlier. WTI also pushed closer into backwardation, ending the week at roughly neutral on the 1-2 month spread. The relative strength of the very short end of the curve likely reflects the market pricing in a known variable of lower supplies from OPEC+ against a more intangible impact of how a trade war will affect commodity demand. Indeed, the impact from a trade war is a more medium- to long-term issue and Dec spreads weakened sharply over the last week.