The UAE was probably the fastest growing economy in the GCC last year, according to a recent tweet by HH Sheikh Mohammed bin Rashid al Maktoum, prime minister of the UAE and ruler of Dubai. Gross domestic product grew 3.8% in real terms in 2021, a better outcome than most analysts had anticipated, and faster than the 3.2% growth seen in Saudi Arabia.

Data from the Statistics Centre of Abu Dhabi showed the emirate’s economy grew 1.9% last year, as a modest contraction in the oil & gas sector offset non-oil sector growth of 4.1%. The recovery was most evident in the manufacturing and wholesale & retail trade sectors as Covid-19 restrictions were eased. The Dubai Statistics Centre has yet to release full year 2021 GDP data but based on the figures for Abu Dhabi and the whole UAE, we estimate Dubai’s economy grew around 6.5% in 2021.

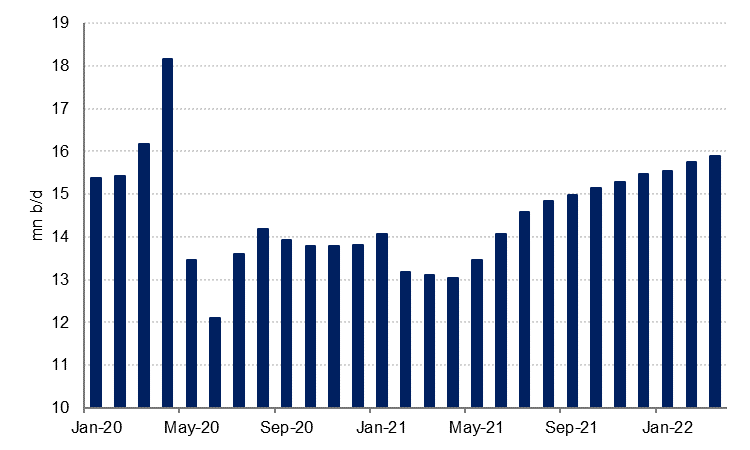

GCC economies have seen a relatively strong start to 2022. The hydrocarbons sectors have benefitted from increased oil production so far this year, with crude oil production up 12% on Q1 2021 for the UAE and 19% over the same period for Saudi Arabia.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Survey data for the first quarter of the year point to a solid expansion in non-oil sectors as well, with strong growth in business activity and new work in the UAE, Saudi Arabia and Qatar. For Dubai in particular, Expo 2020 has helped to boost activity over its duration, and the relaxation of travel restrictions has contributed to a strong recovery in the tourism and hospitality sector over the same period. International visitor numbers have recovered to around 70% of pre-pandemic levels in the first couple of months of this year. Hotel occupancy bounced back in February to over 80% after slipping in January as a result of the Omicron variant of Covid-19, and hotels have been able to almost double their revenue per available room in the first two months of 2022, compared with the same period a year earlier.

.png) Source: S&P global, Emirates NBD Research

Source: S&P global, Emirates NBD Research

The largest source market for international visitors to Dubai so far this year has been Saudi Arabia, which has displaced India from the top spot, and visitors from other GCC countries have returned in larger numbers as well as travel restrictions have been relaxed. There has also been a sharp rise in the number of visitors from the UK and Europe relative to early 2021 as those countries have signalled a desire to “live with” the coronavirus. With the reopening of other markets such as Australia, New Zealand and Singapore, we are optimistic that the recovery in international tourism will continue over the course of the year, underpinning growth in the UAE’s transport and hospitality sectors. The FIFA World Cup in Qatar later this year will likely also benefit the travel hubs in the UAE and neighbouring countries as well as provide a boost to Qatar’s own economy.

Overall, the outlook for the region remains constructive. Expected fiscal surpluses will allow governments to spend as planned without needing to tap debt markets in a rising interest rate environment. Recent reforms to the personal and business laws in the UAE will likely continue to drive inward investment and attract talent.

Nevertheless, there are headwinds to growth, not least from inflation and rising interest rates. Consumers in the UAE are likely to see their purchasing power eroded by rising prices. Petrol prices have increased by two-thirds over the last year as they have been adjusted in line with higher global oil prices. This will raise costs for many businesses that have to pay more to transport goods to and within the UAE. Higher food prices are also likely to leave less money available for households to spend on more discretionary items. Finally, interest rates in the UAE and the rest of the GCC will rise in line with those in the US, raising the cost of mortgages and other loan repayments. As a result, while we still expect the non-oil sectors of the economy to grow in 2022, the rate of growth will probably be slower than it was in 2021.

A version of this article appeared in The National on 19 April 2022